Per week could also be a short while in politics, however in prediction markets it may possibly really feel like an eternity. Simply days after our inaugural Prediction Pulse, the world of Kalshi and Polymarket has managed to fire up extra controversy, sharpening the controversy over how far these platforms ought to go in turning present occasions into commodities.

Final week, we famous Polymarket’s penchant for seizing viral moments and repackaging them as buying and selling alternatives – generally with little regard for style or timing. Since then, the pattern has solely deepened, and Kalshi seems to have dipped its toes into comparable waters. The result’s a rising unease about whether or not these markets are clarifying public sentiment or exploiting it.

For now, nevertheless, all eyes are fastened on a geopolitical stage moderately than a buying and selling ground. The assembly between US President Donald Trump and Russian President Vladimir Putin has turn out to be the most recent flashpoint. Each Kalshi and Polymarket are busy framing the high-stakes diplomacy when it comes to chances and payouts (like we noticed with Iran), desirous to chart the trajectory of a relationship that might form international affairs for years.

The query is whether or not merchants are capturing the heartbeat of geopolitics, or just benefiting from its heartbeat.

What’s on this week’s prediction markets

Kalshi

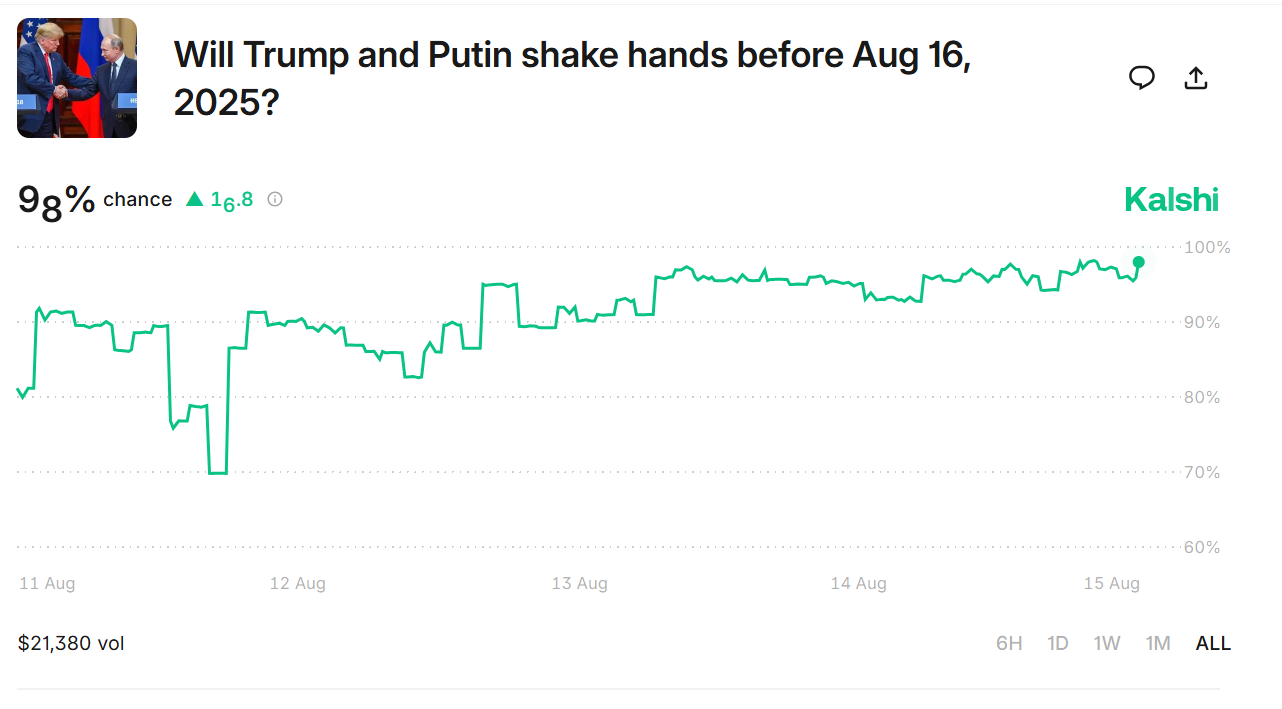

Kalshi’s merchants have been busy this week, and nothing has drawn extra consideration than the Trump-Putin summit in Alaska. The most well liked guess on the platform put a near-certain 98% probability on the two leaders shaking hands earlier than Saturday (August 16). A small gesture, maybe, however one which prediction markets determined to enlarge right into a headline occasion.

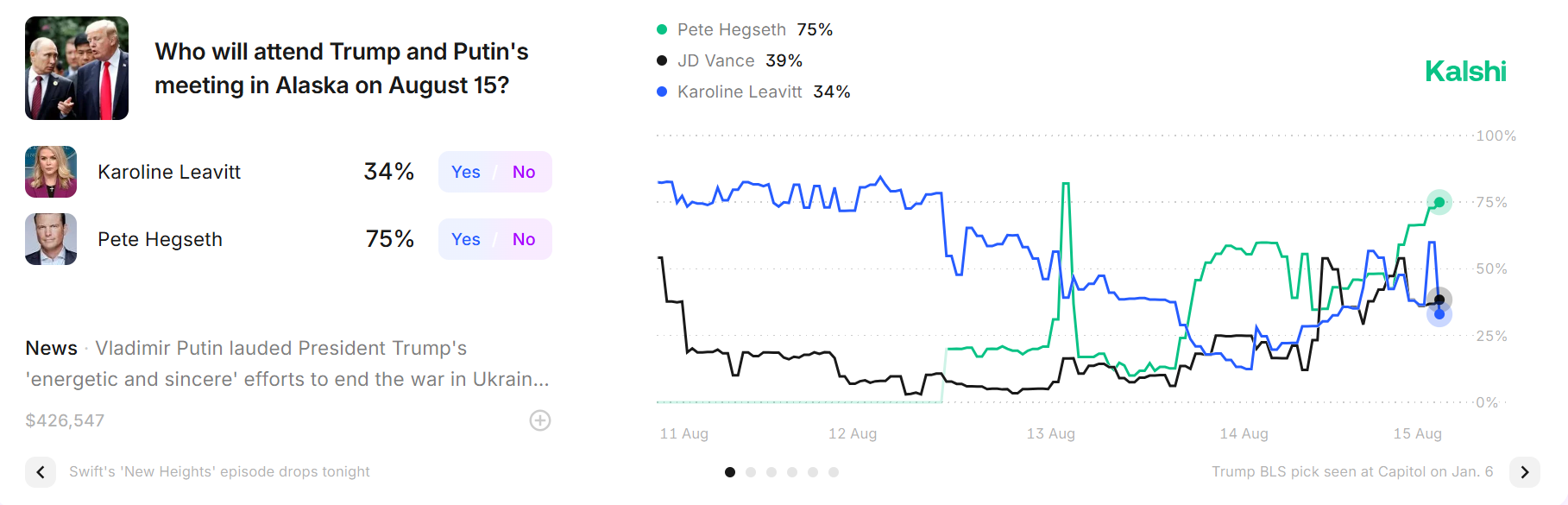

Then got here the guessing recreation over who would be a part of Trump on the journey. Early within the week, Secretary of State Marco Rubio seemed like a lock, buying and selling at 92%. By midweek, although, the hype had shifted. His odds tumbled, Vice President JD Vance climbed, and Trump’s long-time {golfing} companion and ‘Putin whisperer,’ Steve Witkoff, out of the blue seemed just like the insider’s decide.

By Friday, the market had turned once more, this time favoring Protection Secretary Pete Hegseth at 75%, due to chatter about hard-nosed negotiations over Ukraine.

In fact, prediction markets love volatility, however actuality tends to meet up with them. The ultimate delegation is now confirmed: Rubio, Vance, Witkoff, Hegseth, and Treasury Secretary Scott Bessent. For all of the week’s drama, the bettors weren’t completely flawed, just a bit expensive in how they bought there.

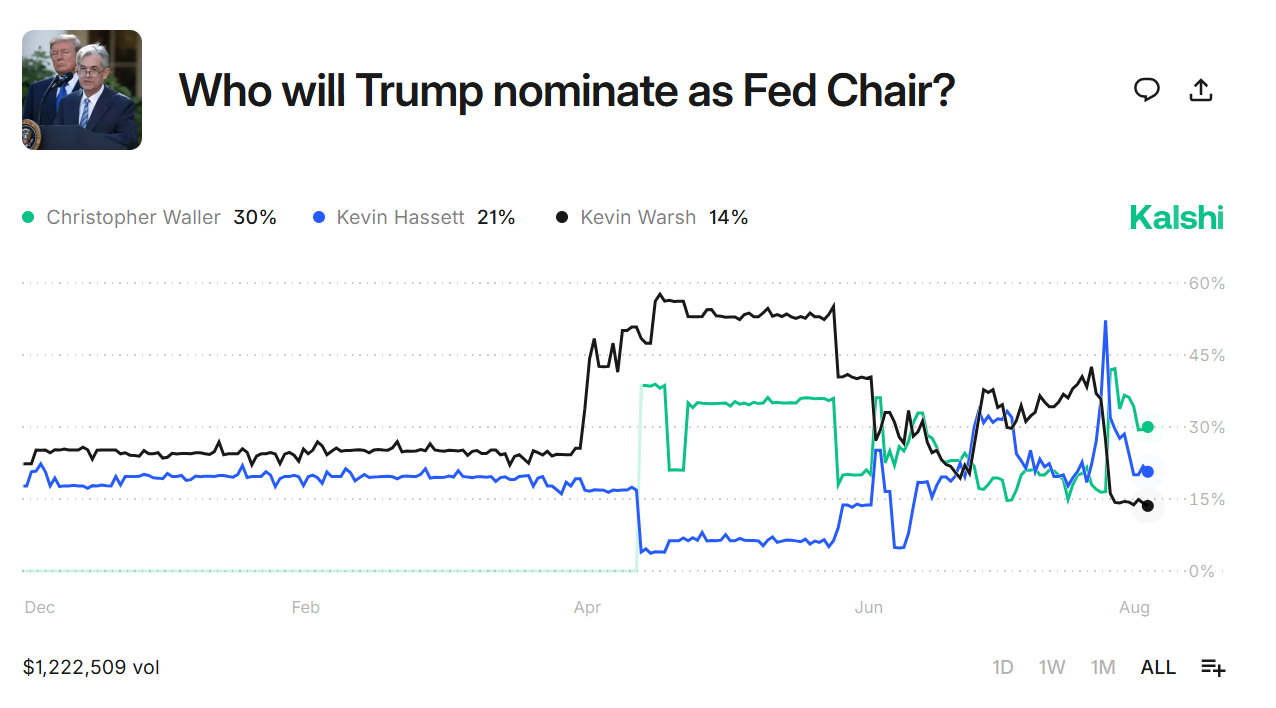

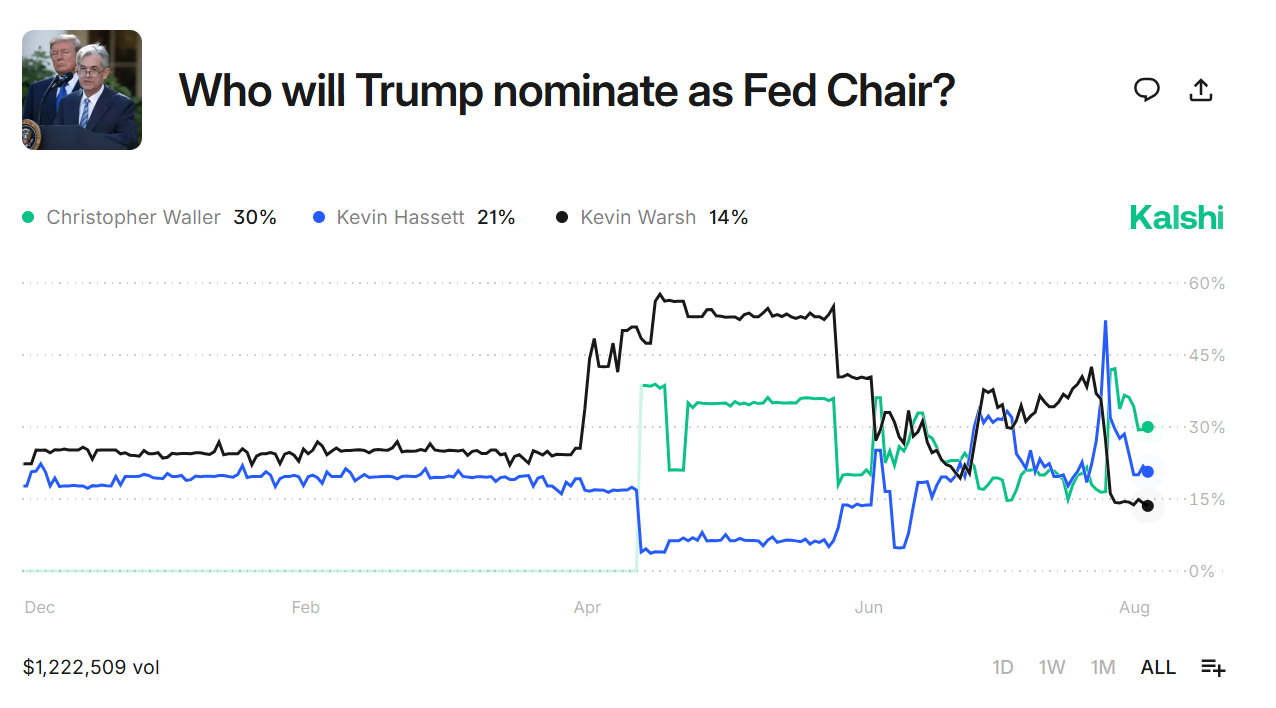

It wasn’t simply geopolitics that stored the markets guessing this week. Kalshi additionally lit up with wagers over who will succeed Jerome Powell as soon as his time period as Fed chair expires subsequent 12 months. The newest identify to surge into the dialog was David Zervos, Jefferies’ chief market strategist.

On Wednesday, his odds jumped to fifteen% after stories surfaced that President Trump is weighing a large area of 11 contenders. The listing now contains Zervos, former Fed Governor Larry Lindsey, and Rick Rieder, BlackRock’s chief funding officer for international fastened earnings. For a quick stretch, Zervos even edged out Kevin Warsh, the one-time favourite, with merchants giving him a 17% probability versus Warsh’s 14%.

The frontrunner, although, stays Fed Governor Chris Waller, holding regular at 30%. Nationwide Financial Council Director Kevin Hassett sits in second place at 21%. Each Hassett and Warsh noticed their odds leap after Trump praised “the Kevins” throughout a CNBC interview final week, calling them “excellent.”

If the Trump-Putin handshake and Fed chair sweepstakes stored Kalshi busy, Wednesday introduced a sharper controversy. Stories surfaced that the platform briefly listed a market on whether or not baseball star Shohei Ohtani can be arrested. By the afternoon or night, the market vanished from the positioning.

The timing advised a knee-jerk response to headlines about Ohtani and his agent being sued over an actual property deal in Hawaii. The catch, in fact, is that the case is civil, not felony. That made the “arrest” framing each deceptive and inflammatory. The URL that when hosted the market now not works, however Kalshi watchers rapidly flagged its existence.

Even one other wager, on whether or not the Hawaii Circuit Courtroom would aspect with Ohtani and his agent within the lawsuit, seems to have been taken down. Each contracts fell underneath Kalshi’s “self-certified” classes, on this case “CASEWIN” and “ARREST,” which permit for speedy posting when a information story breaks.

Kalshi has tiptoed round controversial listings earlier than. It stayed away from the extra outrageous fare Polymarket thrives on, like bets about intercourse toys being thrown at WNBA video games, nevertheless it did take warmth earlier this 12 months for posting a market on the destiny of the person accused of murdering UnitedHealth’s CEO. The Ohtani episode means that, regardless of the guardrails, Kalshi remains to be feeling out the boundaries of style and accountability in actual time.

Polymarket

Polymarket, by no means one to overlook an opportunity at over-analysis, has sliced the Trump-Putin summit into bite-sized wagers. Will they shake hands? Will they commerce insults? How lengthy would possibly the handshake linger? It’s much less a diplomatic summit than a Vegas prop guess.

🚨 NEW POLYMARKET: What’s going to Trump say throughout his convention with Putin tomorrow?

— Polymarket (@Polymarket) August 14, 2025

As of Friday, merchants had been practically sure, 95%, that the palms would clasp. The true motion got here within the aspect markets. Bettors gave a 71$ probability that Trump would discuss of a ceasefire, and simply as a lot that he would dangle new sanctions. Even Joe Biden, who’s nowhere close to Alaska, by some means ended up as a potential cameo within the betting slips.

BREAKING: “No bag coverage” has been applied for tonight’s WNBA recreation in an try to crack down on dildo throwers.

— Polymarket Sports activities (@PolymarketSport) August 6, 2025

Polymarket is not only operating markets lately, it’s also chasing virality on social media. Twice previously week, its X/Twitter accounts have posted issues that merely weren’t true. Essentially the most infamous was a put up from its sports activities account declaring:

“BREAKING: ‘No bag coverage’ has been applied for tonight’s WNBA recreation in an try to crack down on dildo throwers.”

The tweet racked up greater than 43 million views, in response to X’s metrics, however there was one drawback: the coverage doesn’t exist. No information outlet reported it, no league announcement backed it up, and when Yahoo Sports activities and The Sporting Information seemed into the matter, they printed items debunking the declare outright. A reporter from Entrance Workplace Sports activities even confirmed with the Golden State Valkyries that no change in bag coverage had been made for that night time’s recreation.

I noticed some posts on right here concerning the WNBA altering its bag coverage for tonight’s recreation in Golden State.

The Valkyries inform me that’s not true, they haven’t modified the bag coverage for the sport.

— Margaret Fleming (@mgfleming12) August 6, 2025

The episode is a part of Polymarket’s ongoing fixation with the weird pattern of dildos being thrown onto WNBA courts, a spectacle it has became a betting line. Why an organization that touts itself as a “truth machine” is so decided to show faux bag bans and flying intercourse toys into income streams is anybody’s guess.

Featured picture: Canva / Grok

Trending Merchandise